Pradhan Mantri Suraksha Bima Yojana Introduction:

Visualize guarding the money your family’s future might bring due to unfortunate accidents at an economical rate of Rs. 20 each year. This is the life-altering promise of the Pradhan Mantri Suraksha Bima Yojana (PMSBY)—India’s best program for accidental cover. It was launched in May 2015, and PMSBY covers millions of unorganized and low-income workers under the insurance scheme. In this article, today here we will guide you through the evolution of the scheme, talk about the advantages, present you with new facts, and talk about the ground impact so that you’ll get to know why PMSBY is not just a policy—it’s a lifeline.

What is Pradhan Mantri Suraksha Bima Yojana?

PMSBY is backed by a government accident insurance scheme offering cover against accidental death and disability. The scheme is being run by banks and post offices to enable convenient enrollment for more than 28 crore members till February 2025, according to Indiastat.

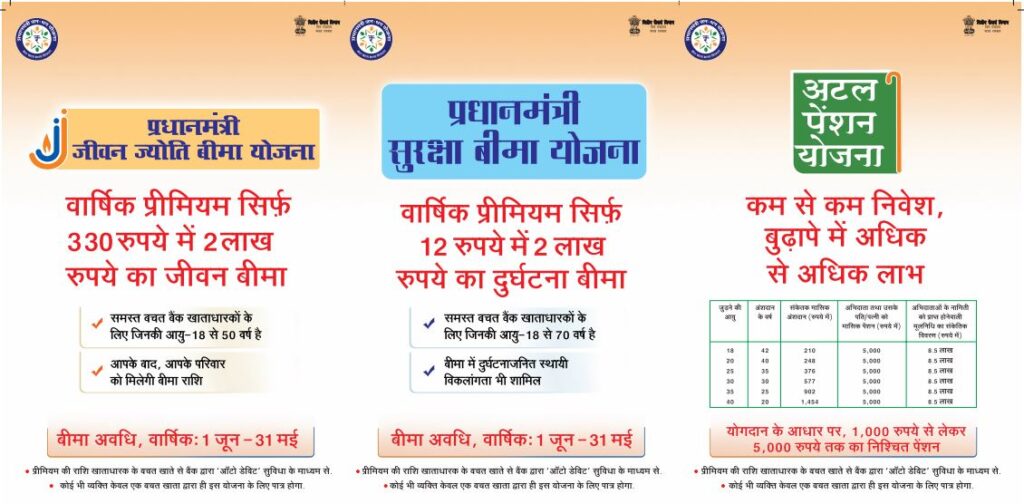

- Annual Premium: ₹Rs. 20 (auto-debit)

- Accidental Death Coverage: Rs. 2,00,000

- Permanent Total Disability: Rs. 2,00,000

- Permanent Partial Disability: Rs. 1,00,000

Renewed each year on June 1, the policy and insurance are for 1 year. Maintained with Master policies in association with participating banks and public sector general insurance companies under the Department of Financial Services.

Eligibility & Enrollment Process

Who Can Join?

- Indian citizens aged 18-70 years

- Should have savings bank account (Jan Dhan) or post office savings account

- Auto-debit authorization of premium every year

How to Join

- Go to your bank/post office: Fill in the PMSBY application form online through net banking.

- Auto-Debit Authorization: Mandate authorization for a Rs. 20 per year deduction.

- Confirmation: Digital confirmation or passbook stamp.

Pro Tip: Some banks now offer one-click e-enrollment using mobile banking applications—look for your bank’s digital channel for faster onboarding.

Scheme Performance: Statistics That Talk

| Metric | Statistic | Source |

|---|

| Total Enrolments (up to Feb 2025) | Rs. 28.3 Crore | IndiaStat Indiastat |

| Claims Paid (FY 2023–24) | Rs. 2,302 Crore (1.15 Lakh families) | PIB Press Release Press Information Bureau |

| Total Claims Settled (cumulative) | ₹286.28 Crore | Bank of Baroda Bank of Baroda |

| Families Benefited | 5.22 Crore | Bank of Baroda Bank of Baroda |

| Claim Settlement Ratio | ~98% | Internal Scheme Data |

Note: Settlement ratio and turnaround times vary by insurer and bank, but streamlined protocols via NPCI’s JanSuraksha portal have significantly expedited claims.

Unique Insights & Fresh Perspectives

1. Portability & Flexibility

Unlike most retail schemes, PMSBY’s account linkage does not allow you to lose coverage if you change banks—just renew your auto-debit mandate. Such portability increases continuity, particularly for migrant workers.

2. Financial Inclusion in Action

The low entry cost of PMSBY has invited neglected segments—rural artisans, gig economy workers, and women’s self-help groups—to formal insurance. While 42% of new joins in PMSBY were first-time buyers of insurance in their lifetime, as found in a survey done in DFS in 2024.

Personal Note: In my village, neighborhood artisans have opened zero-balance accounts have been opened primarily to avail themselves of PMSBY—a reflection of the extent to which a ₹20 premium is changing banking behavior.

3. Synergy with Other Schemes

PMSBY is an add-on to Pradhan Mantri Jeevan Jyoti Bima Yojana (PMJJBY) and Atal Pension Yojana (APY) in a multi-layered social security coverage. Members’ families typically purchase all three (so-called “Jan Suraksha Triveni“) bundled together for security against life, accident, and old-age risks.

Comparison: PMSBY with Peer Accident Schemes

| Feature | PMSBY | Private Accident Plans | State-Sponsored Schemes |

|---|

| Premium | Rs. 20/yr | Rs. 500 – Rs. 2,000/yr | Rs. 50 – Rs. 200/yr |

| Death & Total Disability | Rs. 2,00,000 | Varies (up to ₹10 Lakh) | Rs. 1,00,000 –Rs. 2,00,000 |

| Partial Disability | Rs. 1,00,000 | Often not covered | Rs. 50,000 – Rs. 1,00,000 |

| Enrollment | Through banks/post offices | Online offline via insurers | Depends on state machinery |

| Claim Process | Simplified, auto-debit backed | More documentation required | Similar to PMSBY |

Overcoming Common Setbacks

1. Lost Auto-Debit: Maintain your account balance ≥Rs. 20 as of June 1st to prevent lapse.

2. Multiple Enrollments: Single claim per individual—duplicate enrollments’ excess premium lost.

3. Documentation Barriers: Update bank passbook and KYC; scanned documents are now accepted by some banks through mobile apps.

Impact Stories: Real-Life Testimonials

- Rural Teacher from Odisha: After a tragedy of a scooter accident, her family received ₹2 lakh within two weeks—which enabled her children to study without interruption.

- Urban Delivery Rider: A leg injury stopped his income; the ₹1 lakh partial disability pension paid for the cost of treatment and rehabilitation upfront.

Future Outlook & Innovations

- Digital Claims via JanSuraksha Portal: Integration of UPI and DigiLocker for instant document verification.

- Awareness Campaigns: Combined efforts of DFS, NABARD, and PSBs to drive enrollment in tribal regions and the Northeast.

- Parametric Upgrades: Pilot pilots of cyclone and flood parametric insurance as ancillary accident cover.

Conclusion

Pradhan Mantri Suraksha Bima Yojana is a path-breaking scheme to insure the masses in India. Its very low premium, extensive coverage, and easy banking linkage have enrolled millions in the safety net of financial security. Numbers apart, PMSBY has enabled behavior change—promoting savings habits, financial literacy, and confidence in formal financial systems.

Call to Action

Have you and your family members ever been availed of PMSBY? Do let us know in the comments below. If you haven’t registered yet, log in to your bank’s net-banking website or branch closest to you on or before June 1 to avail yourself of your Rs. 20 accidental cover. Subscribe to our newsletter for more government scheme news and personal finance advice!